Don’t get taken for a ride; protect yourself from an auto loan you can’t afford

Owning a safe and affordable vehicle can be essential for daily life, but the terms of your auto loan may threaten your financial stability. Our new resources can help. This is the fifth post for our blog series on auto loans.

A vehicle may be a lifeline for you or your family if there are no local employment opportunities or inadequate public transportation options. For some, access to affordable vehicle financing is necessary when it comes to stable employment, healthcare, and education opportunities. Even though your vehicle can help you to access economic opportunities or achieve financial independence, it can quickly become a financial burden if you don’t learn how to protect yourself from getting stuck with an auto loan you can’t afford. Here are four ways you can protect yourself:

1. Be prepared before you shop for an auto loan

You can’t always plan the timing of purchasing a new or used vehicle, but you can take steps to prepare. Not being prepared can potentially cost you hundreds or thousands of dollars over the life of the loan.

- Check your credit score before shopping for an auto loan and make sure your credit report doesn’t have any errors so you can negotiate the best rate. You may be able to take some steps that will help you raise your score in a relatively short period of time. A better score will secure a lower interest rate and reduce the amount of money that you end up paying.

- Take our new auto loan worksheet with you to the lender or auto dealership to compare the total cost of different financing options. The first step is to record each loan offer and compare them using interest rate and length of the loan. This might take some time, so plan ahead.

Read more about planning ahead before you shop for a loan.

2. Know what you can negotiate

Just like you can negotiate the price of the vehicle, you can also negotiate your loan terms. You can negotiate for a better interest rate, the length of your loan, additional fees, optional add-ons, and some dealer fees. Our auto loan worksheet can help you keep track of all the factors of your loan that you can negotiate.

3. Avoid long-term loans if you can

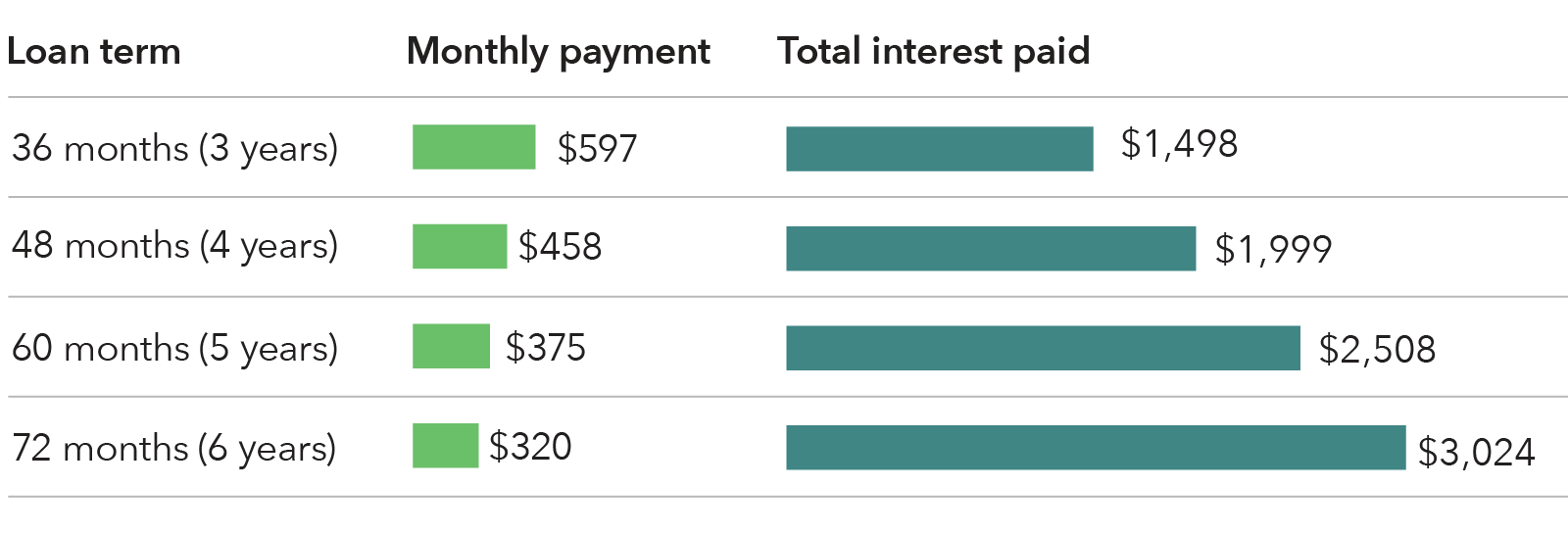

When comparing your offers and negotiating a loan, it’s important to know if you can afford the monthly payment, but be sure you look at the total cost of the loan. A smaller monthly payment may mean the loan is extended over a longer period of time - 72 months or more, instead of 48 or 60 months. If your income or job is not secure, having an extended loan is a risk as you could lose the ability to make monthly payments in the future. For older vehicles, a longer loan could be a problem if the life of the loan is longer than the expected life of the vehicle. For example, in the chart below, you can see how a lower monthly payment increases your total cost:

4. Review your loan contract before signing

Before you sign your new loan contract, make sure everything matches what you agreed to during the negotiation. Consider reviewing with a friend or partner to help you review all of the paperwork before signing the loan documents. Lenders are required, under the federal Truth in Lending Act (TILA), to give you written disclosures about important terms before you’re responsible for the loan.

Check the Annual Percentage Rate (APR), and the amount financed, as well as the finance charge and total of all your payments. Some dealers will allow the customer to take possession of the new vehicle before the loan is approved by the lender. This could put the loan that you thought you had at risk. Before you drive away, make sure you and the lender have both signed all of the paperwork and that you have copies of each document.

Be prepared for your family too

Our resources would also help if you have been asked to be a co-signer for an auto loan. You may be one of many people who want to help a family member or friend, but remember that being a co-signer would put you on the hook for monthly payments if the other borrower stops paying the loan.

We know that all of this information can feel overwhelming. But whether you need a vehicle now or later, we hope that our resources help you and your family to know before you owe!